By Augustine Ehikioya

Since Nigeria’s independence in 1960, poor resources management and corruption in her public life have been major problems to the country.

Despite Almighty God endowing Nigeria with many natural resources in large quantities, to the envy of other nations in the world, the resources have not resulted in corresponding and meaningful improvement in the lives of many Nigerians.

The poor resources’ management have rather brought untold hardship on some Nigerians over the years, especially the poor masses on the street.

Apart from many of them not able to have three square meals in a day, among other social economic effects, the poor resources management and corruption in Nigeria have led to decayed infrastructure and lack of job opportunities’ creation and dearth of critical facilities.

The problem was said to have also indirectly caused insecurity situations in the country by pushing some Nigerians to embrace criminal activities, like armed robbery, kidnapping and banditry.

It was also named as part of the reasons for insurgency that rose against Nigeria in the North East and agitation for resource control in the Niger Delta region.

Not a few Nigerians and foreigners have also baffled why Nigeria has severally resorted to external borrowing in the midst of the massive resources endowment in the country.

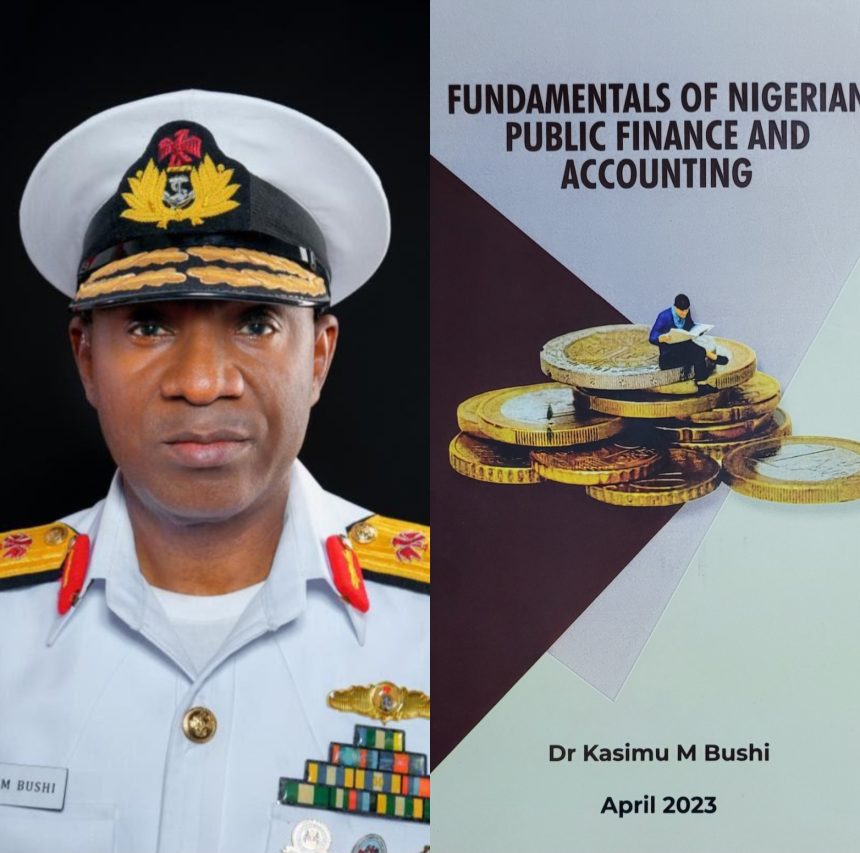

To ameliorate this problems in Nigeria’s public life, an experienced accountant in the public service who is the current Chief of Account and Budget, Naval Headquarters, Abuja, Rear Admiral Kasimu Musa Bushi, has proffered solutions and guidelines that could be life saver for Nigeria if strictly adhered to.

The solutions and guidelines are captured in his new book entitled: “Fundamentals of Nigerian Public Finance and Accounting”, published in April 2023. It has 266 pages and 14 chapters which dwelt on several topics.

The book, whose foreword was written and signed by the immediate past Minister of Finance, Hajiya Zainab Shamsuna Ahmed, was not the first book written by Dr. Bushi.

Among other books authored by him are ‘The Wheels Of Prosperity’ and ‘Understanding the Basics of Nigerian Navy Financial Management and Accounting System’, while he also published four articles in international journal and five in university and local magazines.

In Chapter Four of the new book entitled Financial Recording and Accountability, Dr. Bushi harped on the importance of financial accountability as an essential element for probity and transparency.

According to him, financial accountability serves as the internal check in the public sector accounting system.

He went further to list essential accounting records and books needed in government accounting in order to promote financial accountability.

“Tools for financial analysis for probity and accountability include Development Vote Book, Cash Book, Ledgers, Mandates, Treasury Receipts, Vouchers and Payroll Variation,” he stated.

To block fraud in government accounting, he said some documents are classified as ‘Secret’, and should be kept so, including Treasury Receipt Book, Cheque Book, Unused Local Purchase Orders (LPOs), Stock of stamp and air letter cards (like envelopes), Payment mandates.

In Chapter Six of the book entitled Public Expenditure Management and Controls, he revealed different strategies to adopt in order to prevent financial leakages and other types of financial malpractices in government accounting.

He stated “The ultimate objective is to ensure that public funds are utilized in a way that provides the best value for money. To achieve this goal, it is crucial to ensure that all expenditures are approved and utilized for their intended purposes and that they are correctly classified and recorded.”

Under the chapter, he spoke on expenditure control, and explained its various elements to ensure that all expenditures are ‘wholly’, ‘reasonably’, ‘exclusively’, and ‘necessarily’ incurred for the purposes for which they are meant.

Speaking on fraud control under the chapter, Dr. Bushi said “It has been observed that some employees sometimes take undue advantage of their positions to enrich themselves. However, personnel are enjoined to follow the seven principles of public life set by the Committee on Standards in Public Life (CSPL) led by Lord Nolan, otherwise called the Nolan Principles (1994).

“These principles are selflessness, integrity, objectivity, accountability, openness, honesty, and leadership. Thus, due care should be exercised with these principles to checkmate undue advantages for personal enrichment.”

He listed ways persons in government organization can perpetrate fraud to include concealment or misrepresentation of facts/data, inflation of contract prices, payment for jobs badly executed or not done at all, acceptance of bribes and kickbacks, fictitious claims, embezzlement of profit or public funds, falsification of financial records / documents or outright destruction of financial records or documents.

Stressing that there should be adequate checks to control fraud, he said it can be controlled in two ways, including Administrative and Accounting controls.

He also revealed other critical steps to be taken under internal control measures, control by internal checks, control by internal audit, external controls, control by public accounts committee, control by audit alarm committee and control by conscience money.

In Chapter Seven of the book entitled Public Financial Reporting System, Dr. Bushi pointed out that the Nigerian Public Financial Reporting System (FRS) was generally guided by the Nigerian Accounting Standard Board (NASB), which had the responsibility to provide the Generally Accepted Accounting Principles and Standards (GAAPS).

But he declared that the Nigerian GAAPS have never had a conceptual framework or procedure that guides the preparation of financial reports.

According to him, Nigerian GAAPS did not also provide for full disclosure of accounting information in both public and private entities.

He then went on to discuss public sector FRS to guide the preparation of public financial statements in Nigeria.

Under Chapter Eight of the book entitled Contract Management and Accounting, Dr. Bushi reviewed government’s contract procedure for procurement and construction projects.

For Chapter Thirteen of the book entitled Audit of Public Funds, he discussed various sub-topics and their relevance to public accountability and probity.

Noting that it is difficult to eradicate fraud from human organizations, he however said the organizations can put in place strategies to prevent, deter, and control fraud.

He listed several measures to be taken to manage fraud under three sub-headings of fraud detection, fraud prevention and fraud deterrence.

According to him, internal control faults, doubts about the integrity / competence of management, unusual internal pressures, unusual transactions, and insufficient audit evidence may increase the risk of fraud and error in public audit.

While Chapter One of the book treated Introduction to Public Finance and Accounting, Chapter Two dwelt on Regulatory Framework for Public Finance and Accounting.

Chapter Three of the book was on Budgeting and Appropriation, Chapter Five treated Sources of Public Revenue, Chapter Nine was based on Store Management and Accounting.

The book’s Chapter Ten treated Elements of Taxation, Chapter Eleven was based on Pension and Gratuity, Chapter Twelve discussed Public Debt Management, while Chapter Fourteen dwelt on Public Sector Financial Reforms.

Dr. Bushi, who dedicated the book to the immediate past President Muhammadu Buhari and all his mentors, had over 28 years working experience in the field and administrative appointments on various positions.

Born on 5th of April,1968, Bushi who had PhD in Finance among other qualifications, is affiliated to many national and international institutions.

He has certificate in Fraud Detection and Prevention from the Global Training Consulting, London. He is a Fellow of Chartered Institute of Administration (FCIA), Fellow Chartered System Accountant of USA (FCSA USA), Fellow Certified National Accountant of Nigeria, Fellow Chartered Institute of Corporate Administration of Nigeria, Fellow Chartered Instituted of Finance and Control of Nigeria (FCIFCN), Fellow Chartered Institute of Occupational Safety and Health Association UK, Associate Chartered Institute of Taxation, and Institute of Financial Planning, Lagos.

Bushi, who attended many committees’ conferences and seminars, has made many innovative ideas and contribution to the public service in Nigeria, including initiating the processes that led to the introduction of the National Uniform Number (NUBAN) in 2010 and successfully resolved the problems of military pensioners roaming the streets of Abuja in 2011.

He also holds 28 prominent awards including chieftaincy title, good ambassador of Taraba State award and a host of military awards.

Writing the Foreward of the new book, the immediate past Minister of Finance, Hajiya Zainab Ahmed, stated “For many years, Nigeria has been faced with daunting challenge of ineffective and inefficient use of public resources. This has contributed adversely to nation building as a result of low human development and productivity.

“Clearly, in the last two decades, the Nigerian nation has witnessed gross paradigm shift in the system of public financial management and accounting. This book on ‘Fundamentals of Nigerian Public Finance and Accounting’ written by Rear Admiral KM Bushi, the Chief of Accounts and Budget of the Nigerian Navy, captures the theoretical concepts, practical applications, experimental perspectives of seasoned professionals, and projected effects of these shifts in national financial management.

“It is hoped that the simplicity and strength in the articulation of these initiatives in the book are reflected in their potential impact on public financial management and accountability in Nigeria, so that the national aspirations for economic prosperity and development may quickly be achieved,” she stated.

With Dr. Bushi’s new initiatives, it can only be hoped that urgent changes in the management of Nigeria’s resources will begin in earnest to put her on genuine path of growth and prosperity.

Prudence in the management of the nation’s resources must no longer be sacrificed on any altar, but be taken very seriously for the most populous black nation in the world to survive its many challenges.

This will not only ensure Nigeria never borrows again to fund her budgets, but also boost provisions of necessary infrastructure and creation of job opportunities for the teeming youth.

Also hoping that it will eventually provide good incentives to end insecurity activities linked to social economic problems in the country.